9 Tips to Get a Low Interest Rate on a New or Used Car Loan, Regardless of Your Credit Score

By Benjamin Preston

Regardless of your credit score and whether you’re buying a new or used car, there are always ways to get a better rate on an auto loan.

Consumer Reports consulted experts to give you great advice on how to find the best loan. Read on to see what they recommend.

Check your credit report and score

Generally, a higher credit score means you’ll get a lower interest rate. The opposite is true for those with lower credit scores. That’s because a good score, which is based on a history of paying bills and debt, tells lenders that you’re more likely to pay your bills on time and in full. But a recent Consumer Reports study found that even people with good credit scores can sometimes pay too much for car loans.

In a nutshell: you don’t want surprises. Check your credit report and score a few months before you start shopping for a car so you know where you stand when you start shopping for a loan, advises Jordan Takeyama, public relations manager for Experian, a credit reporting agency. To check your credit score, find out if your bank or credit card offers a free version. For a free credit report, including the financial information your score is based on, visit annualcreditreport.com.

improve your score

This is especially important if you have had credit problems in the past. Sometimes improving a low score is as simple as correcting errors or discrepancies on your credit report. “Most corrections and disputes are completed in 10 to 14 days,” Takeyama says, and credit reporting agencies generally must complete their investigations within 30 days. Paying off existing debts and past-due bills can also give you a last-minute boost. As always, pay credit card, utility and other bills promptly to avoid late fees and further damage to your credit score.

Set a budget and stick to it

As the employees who buy CR’s test cars know, car dealerships can be masters of upselling. Consider your current needs and how they may evolve during the period in which you will have the vehicle in your possession. Resist the temptation to indulge in extras or buy a bigger or fancier vehicle than you need because you’ll likely have to pay for that depreciating asset over the next few years, through a loan, auto insurance, and, potentially, local vehicle taxes.

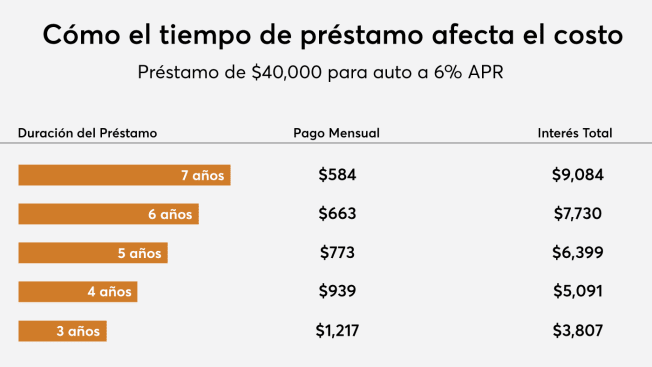

Don’t just look at the monthly cost

Dealers often try to sell you a loan by stressing what you’ll have to pay each month, and that matters, of course, when it comes to your budget. But to get low monthly payments, you may have to extend the loan for long periods of time, which can increase the total cost. Another downside to a long-term loan is that it increases the chance that you’ll end up “underwater” or “upside down” on your loan, which is when you owe more on the car than it’s worth. Of course, a monthly cost that you can handle is also important, so it’s essential that you consider both factors when choosing a loan.

The example below is based on the average new car loan amount and interest rate as of early 2023, rounded down.

Make the highest down payment you can

“That shortens the time you’ll have to pay interest on the loan,” says Alain Nana-Sinkam, director of Triple Double Auto Consulting, a company that analyzes market trends. Depositing more money up front also means you’ll pay interest on a smaller amount of money, which will cost you less overall. “Since interest rates tend to go up, CR recommends that buyers put down at least 15% when buying a vehicle, and 20-25% if they can afford it,” says Chuck Bell, director of programs for Defense of Consumer Reports.

Get pre-approved from your bank

Before you set foot in a dealership, either physically or virtually, contact your bank or credit union and get pre-approved for a loan. The dealership may be able to offer a better financing deal, but having a pre-secured loan gives you a solid starting point for financing negotiations.

If your credit isn’t great, check with car manufacturers for special offers.

Automakers or their dealers sometimes offer special financing to high-risk borrowers, but it’s usually focused on entry-level models. Nana-Sinkam points out that while buying a used car will likely lower your loan amount, some subprime lenders may favor new car loans because these models have strong warranties, making mechanical problems less likely. make it difficult for the borrower to pay on time. Bell says that, like anyone else, subprime borrowers should shop around. “Often the best rate will be obtained from a credit union, bank, or third-party lender, rather than broker-based financing,” he says. “Know what the going interest rates are for borrowers in your credit score range and shop around for deals before heading to the dealership,” she adds.

Consider buying a used car

Newer used vehicles have become more expensive in recent years, but money can be saved by buying an older model. Although interest rates tend to be higher on used car loans, reducing the loan amount can result in significant savings. But be warned: Interest rates can be significantly higher at some used car dealers, especially so-called “buy here, pay here” dealers, according to research from the Bureau for Consumer Financial Protection.

Report if you suspect discrimination

Black and Hispanic borrowers with the same creditworthiness as whites pay nearly 1 percentage point more in interest on auto loans, according to a 2021 study. The study also found that borrowers of color were slightly more likely to be will directly deny them a loan. If you suspect discriminatory lending, file a complaint with the Consumer Financial Protection Bureau or the Federal Trade Commission.

Consumer Reports is an independent, nonprofit organization that works side by side with consumers to create a fairer, safer, and healthier world. CR does not endorse products or services, and does not accept advertising. Copyright © 2023, Consumer Reports, Inc.

Consumer Reports has no financial relationship with the advertisers on this site. Consumer Reports is an independent, nonprofit organization that works with consumers to create a fair, safe, and healthy world. CR does not endorse products or services and does not accept advertising. Copyright © 2023, Consumer Reports, Inc.